Going on a trip, whether for work or fun, is exciting. But, life can surprise us with unexpected events. These can ruin your plans and leave you in a tough spot financially. That’s why travel insurance is so important. It acts as a safety net for your travels. But, you might wonder, is travel insurance really necessary, or is it just a waste of money?

Key Takeaways

- Travel insurance provides essential coverage for trip cancellations, medical emergencies, and lost luggage.

- It offers peace of mind and financial protection during your journey.

- Coverage is typically available to U.S. residents of all states and the District of Columbia.

- Policies may include benefits such as trip cancellation, trip interruption, travel delay, and accidental death and dismemberment (AD&D).

- Understanding the basics of travel insurance can help you make a smart choice for your next trip.

Understanding Travel Insurance Fundamentals

Starting a journey safeguard is exciting, but you need the right tourist policy for safety. Travel insurance offers many coverage options. This ensures your voyager assurance is always secure.

Types of Coverage Available

Travel insurance covers many things like trip cancellations, interruptions, medical emergencies, and lost bags. These options help you financially in unexpected situations while traveling.

Basic Terms and Definitions

Knowing key terms like “premium,” “deductible,” and “benefit limit” is important. The premium is what you pay for the policy. The deductible is what you pay first before insurance helps. The benefit limit is the most the insurance will pay for a claim.

How Insurance Policies Work

Travel insurance policies help by paying for covered losses or offering help in emergencies. They are backed by insurance companies but have limits and exclusions. Always check your policy to know what’s covered and what’s not.

“Protect your journey safeguard with a comprehensive tourist policy that provides voyager assurance for all your travels.”

Why Travel Protection is Essential in Today’s World

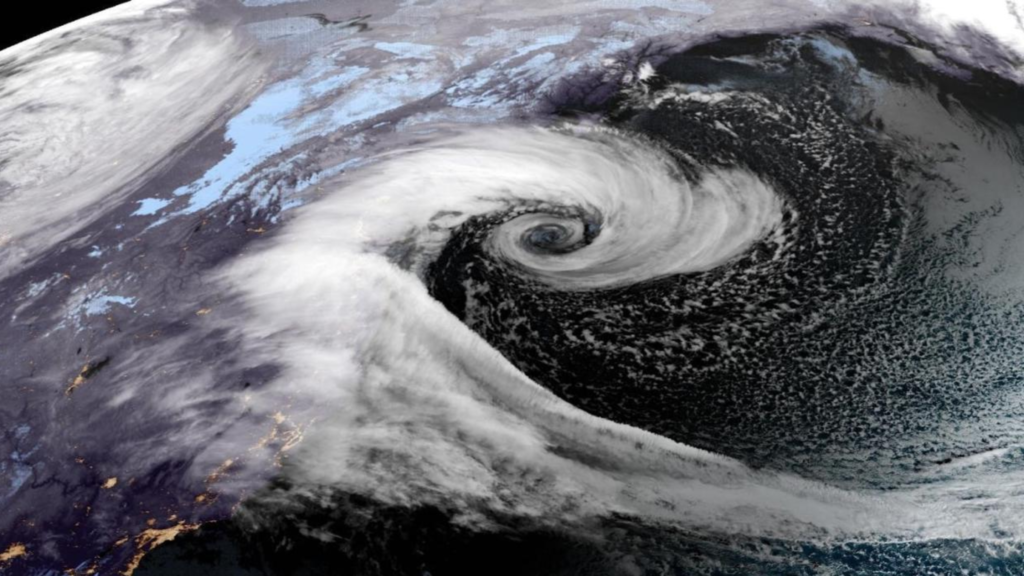

In today’s world, travel protection is key for explorers and adventurers. Natural disasters, political issues, and health crises are common. Having explorer indemnity and wanderlust security helps travelers face the unexpected with confidence.

Travel protection offers financial safety against unexpected events. This includes trip cancellations, medical emergencies abroad, and travel delays. Whether for a vacation or business trip, a good plan is vital to avoid risks and protect your investment.

The cost of travel protection is small compared to your trip. For just $25-$30 for a short flight, you can have peace of mind. This small investment can make a big difference when unexpected challenges arise.

“In today’s world, travel protection is no longer a luxury, but a necessity. It’s the safety net that allows us to embrace our wanderlust with confidence.”

Whether you’re a seasoned traveler or new to the scene, travel protection is crucial. It can turn a good trip into an unforgettable one. With the right coverage, you can enjoy your journey without worrying about the unexpected.

| Benefit | Importance | Average Cost |

|---|---|---|

| Trip Cancellation | Reimburses non-refundable expenses if you need to cancel your trip due to covered reasons | 4-8% of total trip cost |

| Medical Emergency Coverage | Covers medical expenses and evacuation if you experience a health issue while traveling | Included in most plans |

| Baggage and Personal Effects Protection | Compensates you for lost, stolen, or damaged belongings during your trip | Included in most plans |

Core Benefits of Travel Insurance Coverage

As a global adventurer, protecting your journey is key. Travel insurance acts as a global adventurer shield, shielding you from unexpected issues. It covers trip cancellations, medical emergencies, and lost baggage, offering a crucial roaming risk mitigation strategy.

Trip Cancellation Protection

Unexpected events can make you cancel your trip, losing non-refundable costs. Travel insurance can cover up to 100% of your trip cost if you need to cancel. This way, you get your money back.

Medical Emergency Coverage

Getting sick or hurt while traveling can lead to huge medical bills. Travel insurance helps with emergency medical costs. This includes doctor visits, hospital stays, and even medical evacuations if needed.

Baggage and Personal Effects Protection

Lost or damaged personal items can ruin your trip. Travel insurance offers compensation for lost, stolen, or delayed baggage. It also protects your valuable items, helping you recover from these setbacks.

With a good travel insurance plan, you can travel the world with confidence. Your global adventurer shield and roaming risk mitigation are set, making your journey smooth and stress-free.

Cost Factors and Premium Calculations

Travel insurance costs can vary a lot. The price is usually a percentage of your trip’s total cost. It’s often between 5-10% of the total trip cost.

The average cost for travel insurance is about $308 if you shop around. But, if you want a policy that covers trip cancellations, it can cost over $400. Policies that only cover medical issues can be under $100 on average.

How much your trip costs is a big factor in insurance prices. More expensive trips mean higher insurance costs. Your age also matters, as older travelers pay more due to health risks.

| Cost Factor | Impact on Premium |

|---|---|

| Trip Cost | Higher trip costs lead to higher insurance premiums |

| Traveler Age | Older travelers face higher premiums due to increased health risks |

| Destination | Destination does not impact travel insurance costs |

| Trip Length | Generally, trip length does not affect insurance costs, except for specific plans tailored for longer trips |

| Claims History | Claims history does not influence travel insurance costs |

| Medical History | Medical history is not considered in determining travel insurance costs |

While the cost of travel insurance is important, don’t forget its value. It offers protection and peace of mind. Knowing what affects costs helps you choose the right travel insurance for your needs and budget.

Trip Cancellation and Interruption Benefits

Travel insurance is key when planning your vacation. It protects you from unexpected events that might cancel or interrupt your trip. The policy’s trip cancellation and interruption benefits can help with reimbursement for many reasons.

Covered Reasons for Cancellation

Travel insurance covers many reasons for trip cancellation. These include:

- Sickness, injury, or death of the insured or a family member

- Natural disasters that make the destination inaccessible

- Terrorist attacks or civil unrest at the destination

- Unexpected job loss or work conflicts

- Documented traffic accidents or mechanical breakdowns of common carriers

- Unannounced strikes that disrupt travel plans

Reimbursement Procedures

If your trip is canceled or interrupted, you can file a claim. You’ll need to provide proof of the reason, like medical records or a job loss notice. Also, you’ll need to show receipts for any non-refundable costs.

Policy Limitations

While these benefits are helpful, it’s crucial to know the policy’s limits. Some exclusions might apply, like pre-existing medical conditions or certain events. Always check the policy details to understand what’s covered and what’s not.

“Having the right travel insurance plan can give you peace of mind and financial protection in the event of unexpected disruptions to your vacation or journey.”

Medical Coverage While Abroad

When you start a tourist policy or voyager assurance, getting good medical coverage is key. Many think their home health insurance will cover them abroad, but it often doesn’t. The U.S. government doesn’t insure U.S. citizens abroad, and Medicare and Medicaid don’t work outside the country. Private U.S. insurance might not cover you well while traveling.

That’s why travel health insurance is important. It acts as a safety net for emergencies and routine care when you’re away. Whether you’re going solo or with family, a good travel medical insurance plan can help you relax and enjoy your trip.

- Travel health insurance covers many medical costs, like emergency care and hospital stays. It can even cover medical evacuations if needed.

- When picking a plan, think about where you’ll go, how long you’ll stay, and any health issues you have.

- Many travel insurance companies, like UnitedHealthcare Global’s SafeTrip, offer 24/7 help in over 100 languages. This ensures you can get the care you need, no matter where you are.

Getting the right voyager assurance is vital. It lets you focus on making great memories without worrying about medical emergencies. With a good travel medical insurance plan, you can travel with confidence, knowing you’re covered.

Emergency Evacuation and Repatriation Services

When you’re out exploring, the unexpected can happen. That’s when emergency evacuation and repatriation services are key. They offer vital support if you get severely ill or injured abroad.

Medical Transport Coverage

These services can pay for medical transport to the nearest hospital or back home. Costs vary widely, from $15,000 in the Caribbean to over $225,000 in Asia and the Middle East. Top travel insurance plans cover up to $1 million per person for this essential service.

Emergency Assistance Services

Travel insurance also includes 24/7 emergency help. This can mean arranging medical referrals, replacing lost documents, and more. Insurance companies have experts ready to help, speaking many languages, to ease your stress.

| Destination | Estimated Medical Evacuation Cost |

|---|---|

| Caribbean and Mexico | $15,000 – $25,000 |

| South America | $40,000 – $75,000 |

| Europe | $65,000 – $90,000 |

| Asia, Australia, Middle East | $165,000 – $225,000 |

With such high costs for emergency medical transport, having good explorer indemnity and wanderlust security is vital. It protects your health and finances while traveling.

Baggage Loss and Delay Protection

As a global adventurer, keeping your belongings safe is key. Baggage loss and delay protection in your travel insurance is crucial. It acts as a global adventurer shield against roaming risk mitigation. This coverage helps with lost, stolen, or damaged luggage. It also covers the cost of essential items if your baggage is delayed.

Airlines have different waiting times for lost luggage, from 5 to 14 days. Most travelers get their luggage back within a few days. Domestic travelers can get up to $3,800 for lost luggage, the U.S. Department of Transportation says. For international flights, the limit is about $1,780 USD, adjusted every five years.

Travel insurance can also help with costs that airlines don’t cover. Some plans even cover sports equipment like golf clubs and skis. Credit cards and homeowners insurance might offer some coverage, but with limits and deductibles.

For baggage loss and delay protection, comprehensive travel insurance is a big help. Many policies offer $2,500 or more per person for lost baggage. Baggage delay insurance gives daily allowances, usually around $200 per person, to cover essential items until your luggage is back.

Choosing the right travel insurance with strong baggage loss and delay protection is essential. It gives you the global adventurer shield you need for roaming risk mitigation. With the right coverage, you can enjoy your travels without worrying about your belongings.

Travel Delay and Missed Connection Coverage

Travel plans can go wrong, turning a dream trip into a hassle. Luckily, travel insurance often covers these issues. It offers financial help and peace of mind.

Compensation for Delays

Travel delay coverage helps with extra costs from long waits, usually after 3 to 6 hours. It covers meals, lodging, and other travel needs. The amount you can get back varies, from $250 to $1,000 per person.

Alternative Transportation Options

Missed connection coverage helps with rebooking flights or covering extra costs. It’s great for catching up with tours or cruises. It works for delays from airlines, bad weather, or other covered reasons.

But, not all issues are covered. This includes riots, pregnancy, criminal acts, and war. Also, some policies only cover the trip to your destination, not the return.

When picking travel insurance, read the fine print. Look for good coverage for delays and missed connections. The right policy can save you money and stress.

| Coverage Type | Key Benefits | Eligibility Criteria |

|---|---|---|

| Travel Delay | Reimbursement for additional expenses like meals, accommodation, and transportation | Minimum delay of 3-6 hours |

| Missed Connection | Assistance in rebooking flights or reimbursement for additional expenses to catch up with pre-booked travel | Certified delays from common carriers, documented weather conditions, or other covered events |

“Travel insurance is essential for protecting your trip investment and providing peace of mind, especially when it comes to unforeseen delays and missed connections.”

Pre-existing Condition Coverage Options

Travel insurance can be tricky, especially for those with ongoing health issues. But, some plans offer vacation coverage and journey safeguard for those with pre-existing conditions.

To get coverage for pre-existing conditions, you must buy the policy within 14-21 days after your first trip deposit. You also need to insure the full cost of your trip. It’s important to check the policy’s definition of pre-existing conditions and any waiting periods.

Pre-existing condition coverage is valuable, but some exclusions apply. Conditions like Alzheimer’s, mental health issues, and alcohol or drug abuse problems are often not covered. Also, trips over $50,000 might not get a waiver for pre-existing conditions.

| Travel Insurance Provider | Pre-Existing Condition Coverage Details |

|---|---|

| Travel Guard | Offers pre-existing medical condition exclusion waiver when insurance is purchased within 15 days of initial trip payment. Defines pre-existing conditions as injuries, illnesses, or conditions that occurred or worsened within 90 days prior to policy purchase. |

| Allianz Global Assistance | Covers pre-existing conditions if policy is purchased within 14 days of first trip payment, with full non-refundable trip costs insured. Excludes mental health disorders and normal pregnancy. |

For journey safeguard, it’s key to look at your options carefully. Each plan has its own rules and limits. By understanding these, you can make sure you’re protected for your health issues, giving you peace of mind on your travels.

Adventure and Sports Activity Coverage

Going on exciting adventures and sports can make your travels even more thrilling. But, these activities come with their own risks. That’s why you need special insurance for them. Travel insurance for adventure lovers can protect you while you explore, whether it’s climbing mountains, diving deep, or flying high.

Covered Activities

Adventure travel insurance covers many activities, including:

- Mountain climbing

- Scuba diving

- Bungee jumping

- Hot air ballooning

- Trekking and hiking

- Cycling (including BMX and mountain biking)

- Water sports (such as white-water rafting and caving)

- Wildlife expeditions and safaris

Exclusions and Limitations

Adventure travel insurance covers a lot, but there are some things it doesn’t cover. Extreme sports like base jumping and heli-skiing might need extra money or not be covered at all. Also, some activities have rules about your experience or certification. Make sure to check your policy well to know it covers your plans.

| Activity Category | Percentage of Coverage |

|---|---|

| Land-based activities (hiking, trekking, safari) | 42% |

| Assault courses and high ropes | 18% |

| Cycling (BMX, road, mountain) | 10% |

| Motorcycling (off-road and rallies) | 5% |

| Climbing and mountaineering | 3% |

| Water-based activities (caving, rafting, diving) | 7% |

| Extreme sports (bungee jumping, skydiving) | 9% |

| Wildlife expeditions and safaris | 10% |

| Niche activities (volcano climbing, biathlon) | 6% |

| Miscellaneous (paintballing, zip-lining) | 10% |

Choosing the right travel insurance for your adventures ensures you’re covered. This way, you can explore the world safely and enjoy every moment of your journey.

How to Choose the Right Travel Insurance Plan

Choosing the right travel insurance is key to protecting your trip and keeping your mind at ease. Think about the explorer indemnity of your trip, your planned activities, and your wanderlust security needs.

First, look at the cost of your trip. Travel insurance usually costs 4-10% of your trip’s total cost. Policies for non-emergency cancellations can cost 20-50%. The more expensive and longer your trip, the higher the insurance cost.

- Know the difference between insurable and total trip costs, focusing on prepaid, nonrefundable expenses.

- Compare policies from different providers to find the best coverage and value.

- Check for exclusions, like limited COVID-19 coverage.

Then, think about the activities you’ll do on your trip. If you’re into adventure or explorer indemnity, look for policies that cover sports or extreme adventures. Make sure the coverage fits your travel plans and risk level.

| Coverage Aspect | Considerations |

|---|---|

| Trip Cancellation | Covered reasons, reimbursement procedures, policy limitations |

| Medical Emergencies | Coverage limits, network of providers, evacuation and repatriation services |

| Baggage and Personal Effects | Loss, theft, and delay protection |

Lastly, think about your health history and any pre-existing conditions. Many policies cover pre-existing conditions if you buy insurance within 14-21 days of booking.

By carefully considering these points and comparing different travel insurance options, you can find the right plan. This will protect your wanderlust security and let you enjoy your journey with confidence.

Filing Claims and Documentation Requirements

As a global adventurer, having a global adventurer shield is key. But knowing how to file claims and what documents you need is just as important for roaming risk mitigation. Travel insurance is there to protect your trip. Yet, the claims process can be tough if you’re not ready.

Required Documentation

To file a successful claim, you’ll need a claim form and supporting documents. This might include receipts, medical records, police reports, or emails with travel companies. It’s vital to keep all your documents safe for a smooth claims process.

Claims Process Timeline

The time it takes to process claims varies. But, most companies aim to handle simple claims in 10-14 business days. More complicated claims might take longer. It’s important to reach out to your insurance provider early to get updates and ensure your claim is handled quickly.

| Coverage Type | Required Documentation | Average Processing Time |

|---|---|---|

| Trip Cancellation | Completed claim form, proof of cancellation, receipts | 10-14 business days |

| Medical Emergency | Completed claim form, medical records, bills | 14-21 business days |

| Baggage Loss | Completed claim form, police report, receipts | 10-14 business days |

| Trip Delay | Completed claim form, receipts for additional expenses | 10-14 business days |

Filing claims online is usually the fastest way. It lets you easily upload and submit your documents. The key to a successful claim is being proactive, providing all needed info, and keeping in touch with your insurance provider.

“Misunderstanding coverage is one of the most common reasons for denied travel insurance claims. It’s crucial to read your policy carefully and contact your provider with any questions before your trip.”

Common Exclusions and Policy Limitations

Understanding travel insurance is key. Many policies don’t cover pre-existing medical conditions or self-inflicted injuries. They also exclude war or military actions and some high-risk activities. There are also limits on how much they can pay out, age limits, and specific conditions for coverage.

It’s important to read the fine print of any travel insurance policy. Different plans have different exclusions and limits. Knowing these details helps you choose the right trip protection for your needs.

Travel can be unpredictable, and knowing your policy’s limits is crucial. This knowledge helps you make better plans and ensures you’re protected against unexpected events.

FAQ

What is travel insurance and what does it cover?

Travel insurance protects travelers from unexpected events. It covers trip cancellations, medical emergencies, and lost luggage. It gives peace of mind during your journey. U.S. residents can get coverage for all states and the District of Columbia.

Policies include benefits like trip cancellation and medical emergencies. They also cover lost luggage and accidental death and dismemberment (AD&D).

What are the different types of travel insurance coverage?

Travel insurance offers various coverages. These include trip cancellation, medical emergencies, and baggage protection. Basic terms are premium, deductible, and benefit limit.

Policies reimburse for covered losses or provide emergency assistance. Coverage is underwritten by insurance companies. It may have limitations, exclusions, and termination provisions.

Why is travel protection essential in today’s world?

Travel protection is key due to global uncertainties. It safeguards against unexpected events like trip cancellations and medical emergencies abroad. With natural disasters, political instability, and health crises, it ensures travelers can face unforeseen circumstances with confidence.

What are the core benefits of travel insurance?

Travel insurance’s core benefits include trip cancellation protection and medical emergency coverage. It also covers trip interruption and baggage protection. These benefits help recover non-refundable expenses and cover medical costs abroad.

How are travel insurance premiums calculated?

Premiums are based on trip cost, traveler’s age, destination, and travel duration. Additional factors include the type of coverage and optional add-ons. Costs vary, so comparing plans is important to find the best value.

What are the covered reasons for trip cancellation and interruption?

Trip cancellation and interruption benefits cover sickness, injury, death, and natural disasters. They also cover terrorism and job loss. Reimbursement requires filing a claim with supporting documentation. Policy limitations may apply, like exclusions for pre-existing conditions.

What does medical coverage while abroad entail?

Medical coverage abroad is crucial. It includes emergency medical treatment and hospitalization. Policies may cover illness and injury, with varying limits and deductibles. Some plans cover pre-existing conditions, but this often requires purchasing within a specific timeframe.

What are emergency evacuation and repatriation services?

Emergency evacuation and repatriation services are vital for severe illness or injury abroad. They provide medical transport to the nearest facility or back home. These services include 24/7 support for medical referrals and urgent needs.

How does baggage loss and delay protection work?

Baggage loss and delay protection compensates for lost, stolen, or damaged luggage. It also reimburses for essential items purchased due to delayed baggage. Coverage limits and claim procedures vary by policy. Some plans offer tracking assistance for lost bags.

What is travel delay and missed connection coverage?

Travel delay coverage compensates for additional expenses due to significant delays. It covers meals, accommodation, and transportation costs. Missed connection coverage assists in rebooking flights or reimburses for additional expenses to catch up with a cruise or tour.

What is pre-existing condition coverage?

Some plans cover pre-existing medical conditions as an optional add-on. This coverage requires purchasing within a set timeframe after the initial trip deposit. It’s important to review the policy’s definition of pre-existing conditions and waiting periods.

What type of adventure and sports activities are covered?

Adventure and sports activity coverage protects travelers in activities like skiing and scuba diving. Covered activities and limits vary by policy. Extreme sports or professional athletic events are often excluded. Verify that your planned activities are covered.

How do I choose the right travel insurance plan?

Choosing the right plan involves assessing your needs, trip details, and risk tolerance. Consider trip cost, destination, planned activities, and personal health history. Compare plans, focusing on coverage limits, exclusions, and customer reviews. Pay attention to coverage for specific concerns like trip cancellation and medical emergencies.

What is the process for filing a travel insurance claim?

Filing a claim requires submitting a claim form and supporting documentation. This includes receipts, medical records, and police reports. Claims are usually processed within 10-14 business days. It’s important to file claims promptly and provide all requested information to avoid delays.

What are some common exclusions and limitations in travel insurance policies?

Common exclusions include pre-existing medical conditions and self-inflicted injuries. War or military actions and certain high-risk activities are also excluded. Policy limitations include maximum payout limits, age restrictions, and specific conditions for coverage. It’s crucial to review the policy’s fine print to understand what is and isn’t covered.